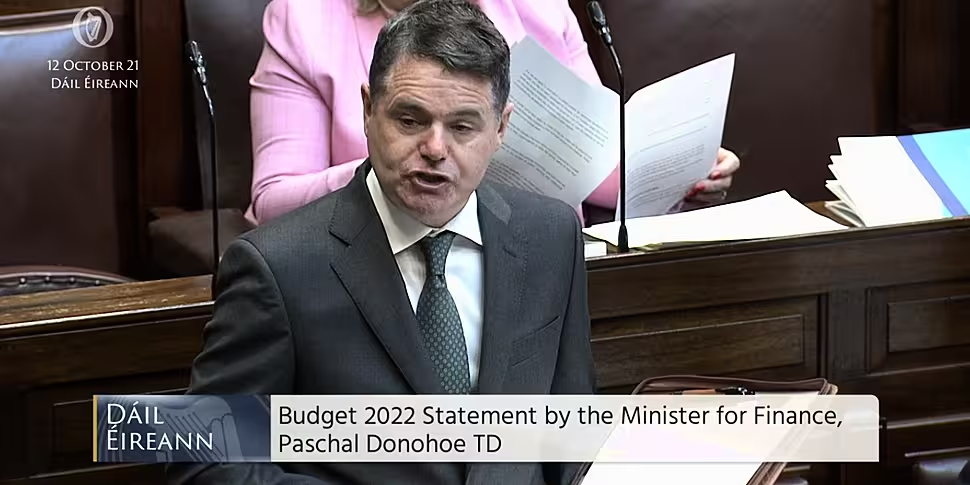

Ministers have announced details of Budget 2022 in the Dáil.

Half price public transport for young people, a large increase in the number of Gardaí and subsidies for childcare are among the biggest measures.

The main weekly welfare payments, including the State pension, are to rise by €5 a week - along with the weekly fuel allowance.

The point at which people start to pay the higher rate of tax will go up by €1,500.

While carbon taxes will also increase from midnight - meaning petrol, diesel, coal and home heating oil will be more expensive.

Here are the main points:

Welfare

- A €5 weekly increase for all social welfare recipients

- The weekly fuel allowance is to increase by €5 from tonight

- The Christmas bonus will be paid in full for 2021

- The State pension will increase by €5

- An extra €3 will be added to the Living Alone Allowance

- More carers will qualify for payments in the first major reform of the Allowance in over a decade

- A COVID-19 contingency fund is being created and includes €500m for testing and tracing, a vaccine booster campaign and PPE

- EWSS scheme extended in a graduated form until April 30th 2022

- No change to the scheme in October and November

- In December, January and February, a two-rate structure of €151.50 and €203 will apply

- In March and April 2022 a flat rate of €100 will be in place - reduced employers PRSI to no longer apply

- Scheme closes to new entrants from January 2022 - The earnings limit on Disability Allowance will rise from €350 to €375

Parents and families

- The Back to School Allowance will go up by €10

- Parents Benefit to increase to seven weeks from July next year

- Plans to freeze childcare fees have been unveiled

- Free GP care will be given to children aged six and seven - with plans to extend it to those up to 12 years

- New funding stream for 4,700 childcare providers from September 2022

- The pupil-teacher ratio in primary schools will be reduced by one point

Taxes

- The lower tax band of €35,300 will rise by €1,500

- A €50 rise in the personal tax credit

- The ceiling for the second band of USC is rising to €21,295

- The USC exemption for medical card holders and those over-70, earning less than €60,000, stays in place

- Carbon tax will rise by €7.50 per tonne - increasing the price of natural gas, bag of coal and bale of briquettes

- The cost of a full tank of petrol will go up by €1.28 and the diesel will go up by €1.50

- The VRT exemption for Battery Electric Vehicles is to be extended to the end of 2023

- A revised motor tax system from January will see:

1% increase in VRT for bands 9-12

2% increase for bands 13-15

4% increase for bands 16-20 - Reduced VAT rate of 9% for hospitality sector will remain in place until August 2022

Cost of living

- The minimum wage is rising by 30c to €10.50 an hour

- The price of alcohol will be unchanged - 50 cent will be added to the cost of a pack of cigarettes from midnight

- A pilot scheme is being introduced to provide a basic income for artists

- The live events sector is to get €25m in support

- €25m for a new Youth Travel Card, which will see 50% discount on public transport for those aged 19-23

Health

- Core health spending is to increase by €1bn, to a record €20.38bn

- 8,000 new posts to be created across the health system

- Free contraceptives for women aged 17-25 from next August

- There is a €250m package to shorten waiting lists

- €105m for disability services

- A package on domestic and sexual violence, including extension of legal aid for victims and funding awareness campaigns

Work

- Working from Home employees can claim back 30% of vouched expenses for heat, electricity and broadband

- An extra 800 Gardaí will be hired and 400 civilian staff

- An extra 980 teachers and 1,165 new Special Needs Assistants (SNAs) to be taken on

- €6.7m for a Youth Justice Strategy to tackle anti-social behaviour

Housing

- €202m is to be spent on retrofitting homes, which will support 22,000 energy upgrades

- The Help-To-Buy scheme will be retained for 2022 at current rates with a 'full review' next year

- A Zoned Land Tax to encourage the use of land for building homes - this will apply to land zoned suitable but undeveloped

- New mica redress scheme to be announced 'in coming weeks'